If you have money and assets in foreign banks or are a US citizen living overseas, Direct Tax Relief can work with you to file an FBAR and avoid tax evasion.

With DTR’s Help

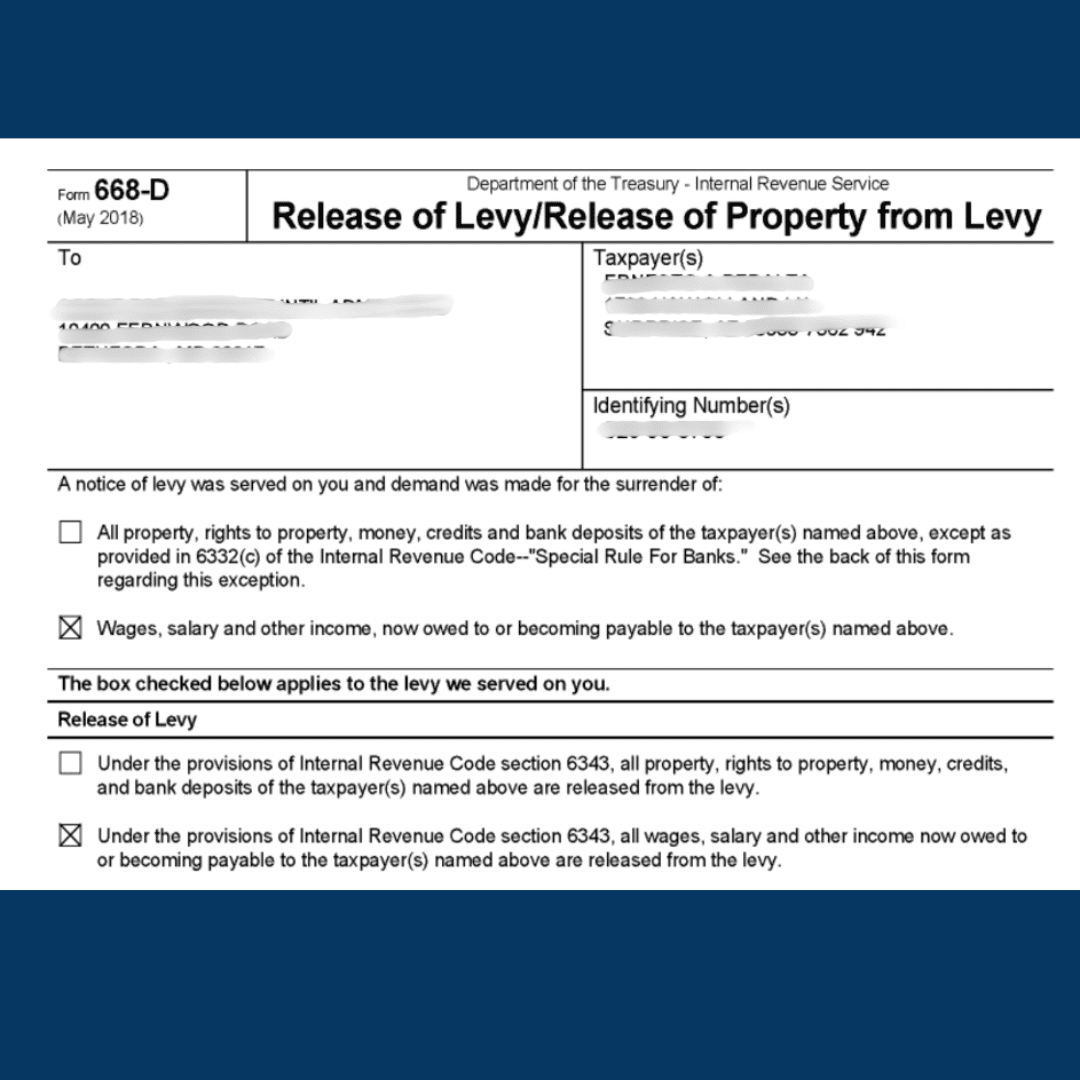

You can have your wage, Social Security and other garnishments released.

Release wage garnishment

Prevent future garnishments

Creates peace of mind

Prevents employer being notified about your tax debt